Termokimia Pengertian Persaman Reaksi Rumus Dan Contoh Soal Soal Sexiz Pix

Pada video pembelajaran ini, Bp. Agung Dinarjito, Dosen PKN STAN dari Jurusan Akuntansi menjelaskan materi Manajemen Keuangan, khususnya tentang konseppresen.

Rumus Bunga Bank, Simak Cara Menghitungnya dengan Mudah! Musafir Digital

PVIF is a powerful tool used in finance. In this video, we will take a deep dive into solving real-world problems using Present Value Interest Factor (PVIF). PVIF is a powerful tool used in.

PVIF & PVIFA calculation present value interest factor BBA Capital budgeting lease

Cara Menghitung PVIF. PVIF dapat dihitung dengan menggunakan rumus matematis sebagai berikut: PVIF = 1 / (1 + r) ^ n. Dimana r adalah suku bunga dan n adalah waktu investasi dalam tahun. Misalnya, jika suku bunga adalah 10% dan waktu investasi adalah 5 tahun, maka PVIF dapat dihitung sebagai berikut: PVIF = 1 / (1 + 0,10) ^ 5 = 0,6209.

PPT NILAI WAKTU UANG (TIME VALUE OF MONEY) PowerPoint Presentation, free download ID5189043

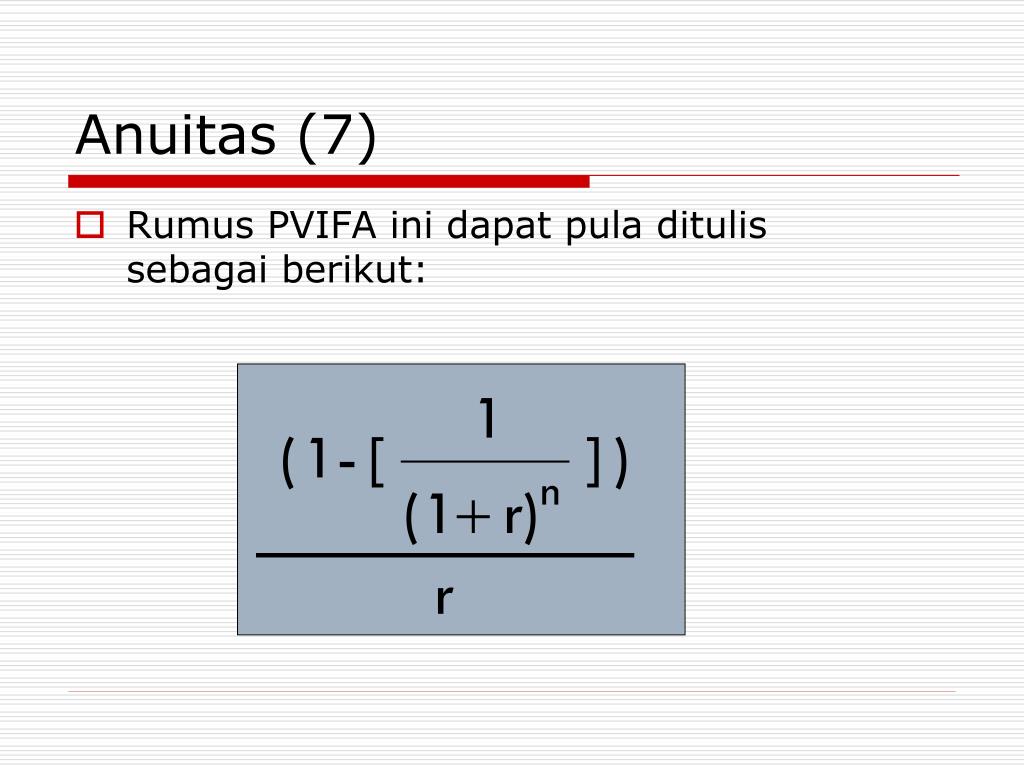

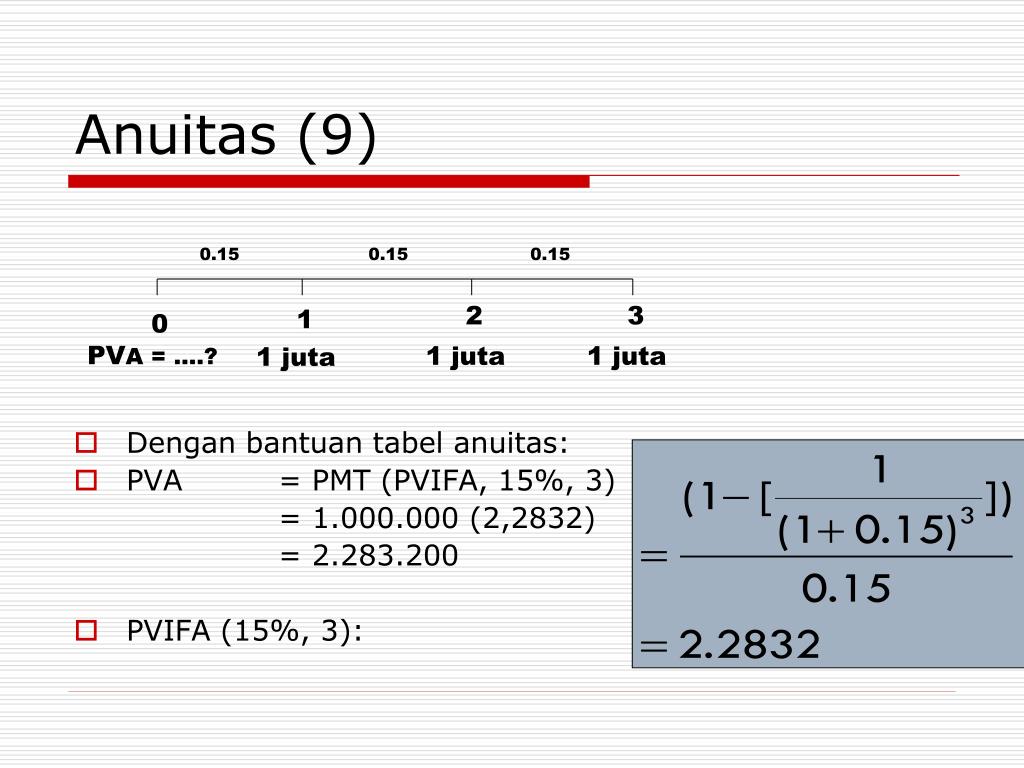

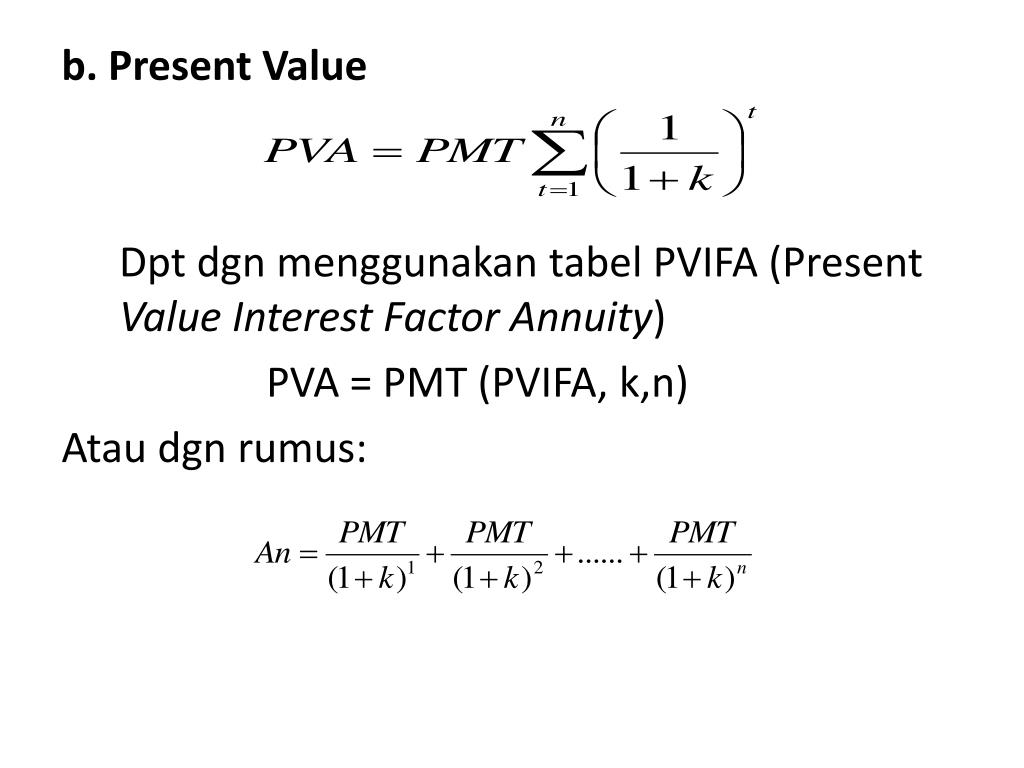

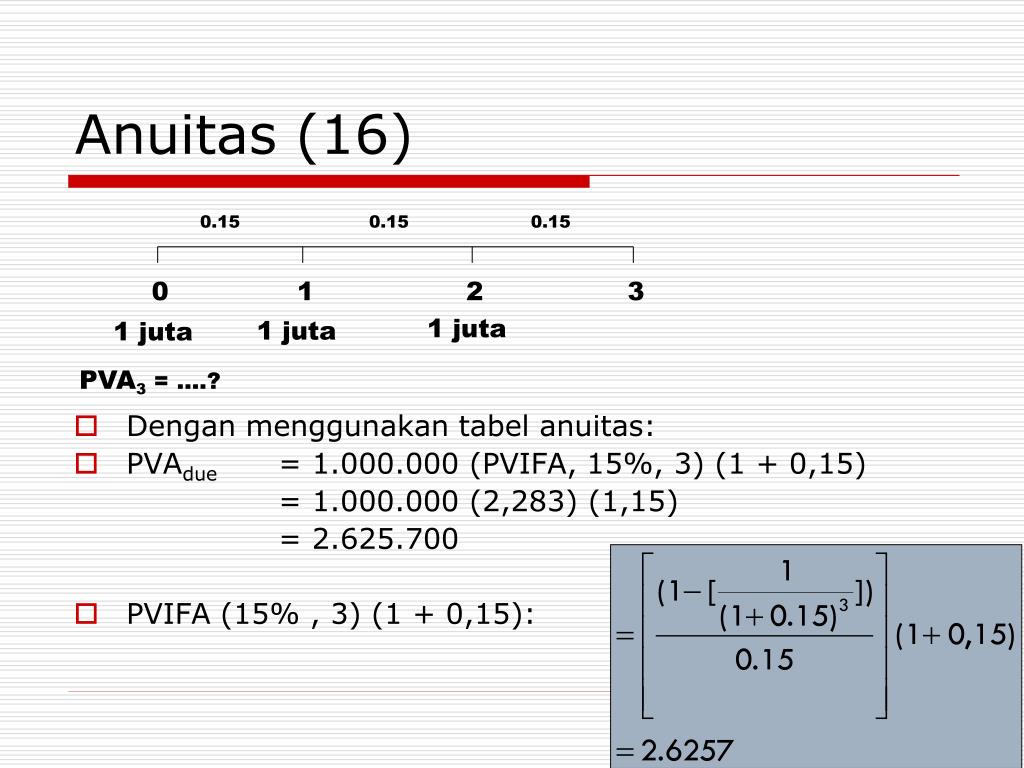

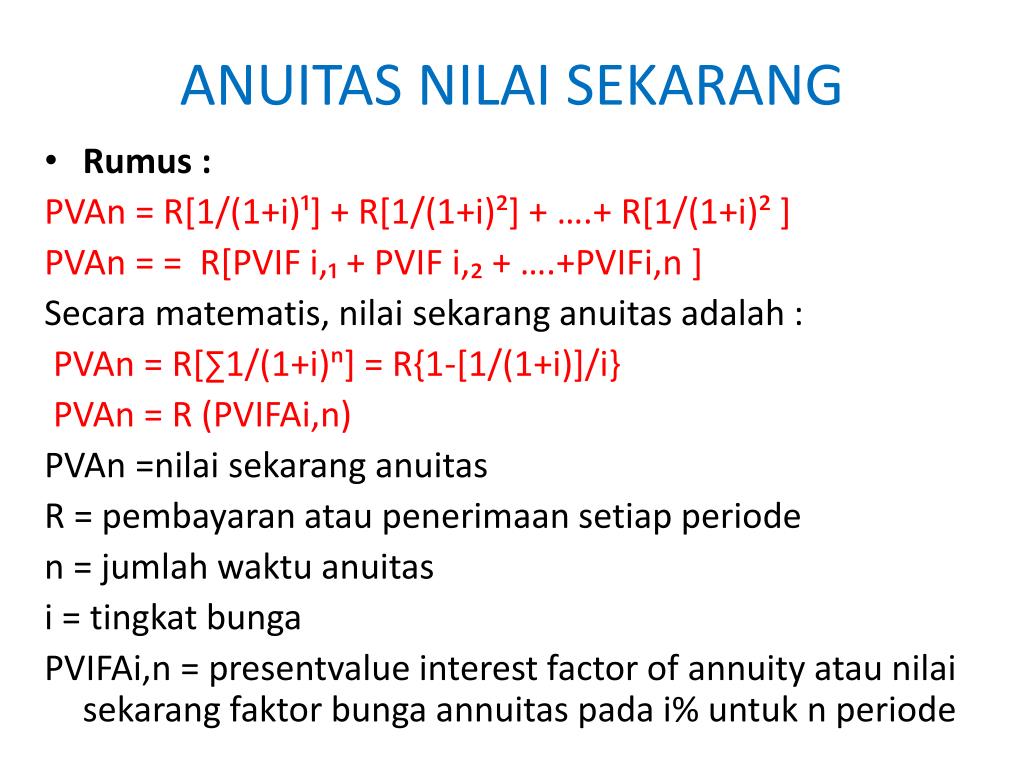

PVIFA Formula. The PVIFA calculation formula is as follows: Where: PVIFA = present value interest factor of annuity. r = interest rate per period. n = number of periods.

How to use PVIF or Present value Interest Factor table YouTube

Rumus 1. PVIF = 1/(1+r)t. r = tingkat bunga pasar per periode; t = jumlah periode; PVIF=1/(1+.04)¹0 = 0,6756. Nilai sekarang dari nilai pokok obligasi = Rp5.000.000 x 0,6756 = Rp3.378.000. Rumus 2. Setelah menghitung nilai sekarang dari nilai pokok obligasi, dilanjutkan dengan menghitung nilai sekarang dari pembayaran bunga.

PPT NILAI WAKTU UANG (TIME VALUE OF MONEY) PowerPoint Presentation, free download ID5189043

• PVIF = 1 / (1+i) n • Multiply any FV by PVIF to get a present value using the same length of investment at the same interest rate. Present Value Example Problem. The default calculation above asks what is the present value of a future value amount of $15,000 invested for 3.5 years, compounded monthly at an annual interest rate of 5.25%.

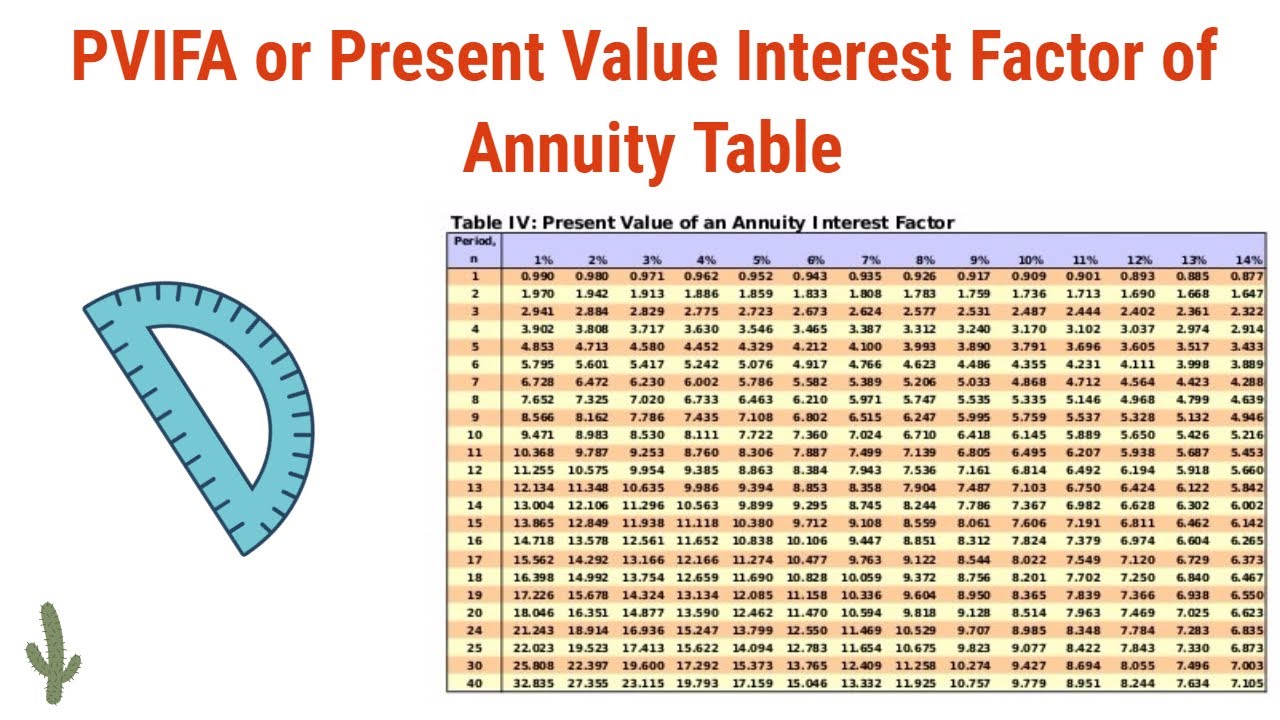

Tabel Pvifa Pvif

Present value interest factor. In economics, Present value interest factor, also known by the acronym PVIF, is used in finance theory to refer to the output of a calculation, used to determine the monthly payment needed to repay a loan. The calculation involves a number of variables, which are set out in the following description of the.

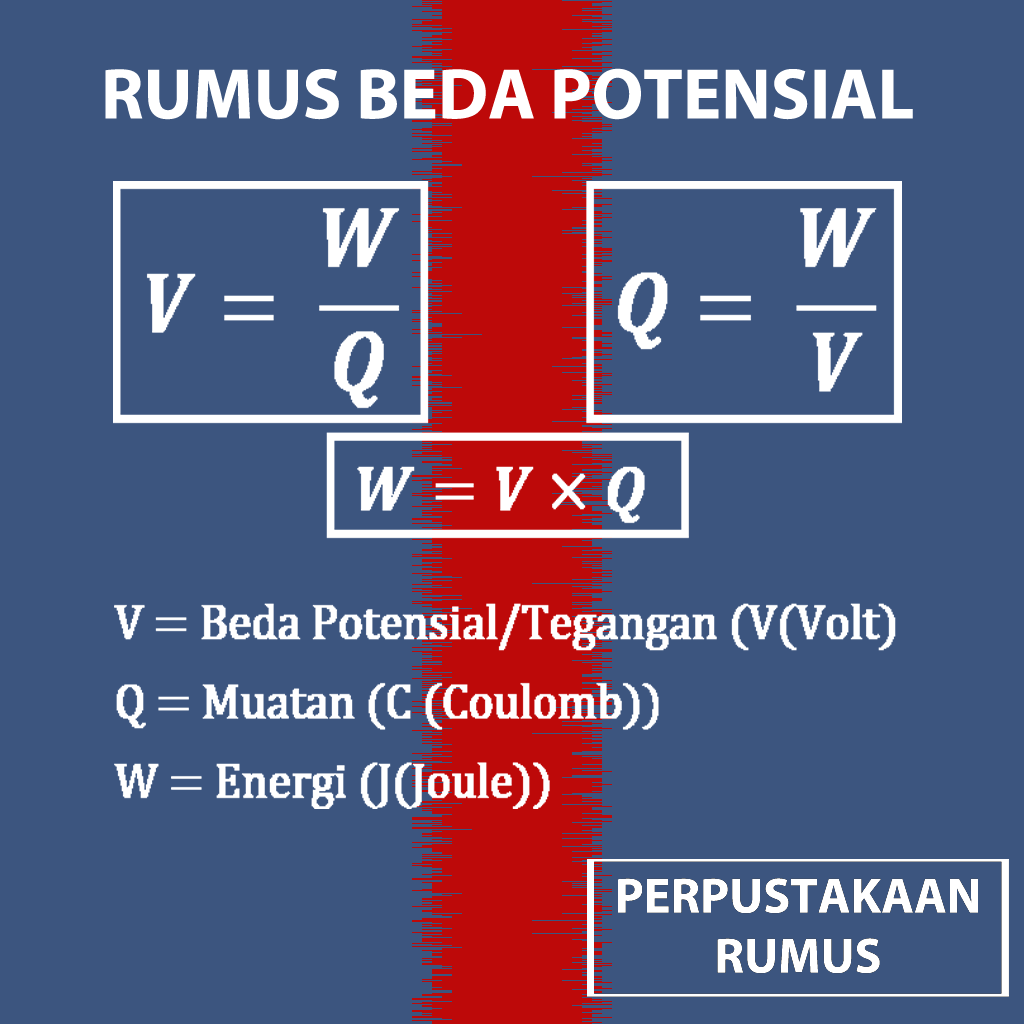

Rumus Beda Potensial atau Tegangan (2)

Leave-Sharing Plan: A plan that allows employees to donate unused sick-leave time to a charitable pool, from which employees who need more sick leave than they are normally allotted may draw.

MEMBUAT TABEL PVIF & PVIFA DI EXCEL YouTube

Perhitungan nilai sekarang dari nilai pokok obligasi bisa dilakukan dengan mengalikan nilai nominal obligasi dengan PVIF. Karena kita belum tahu PVIF-nya, kita harus mencarinya dulu. Rumusnya sama dengan rumus pada cara menghitung obligasi yang dijual pada harga diskonto yang telah dijelaskan sebelumnya, yaitu: PVIF = 1/(1+r)^t

Rumus Cara Mencari Luas Dan Keliling Lingkaran Beserta Contoh Soalnya

Langkah pertama yang harus dilakukan adalah menghitung PVIFA dengan menggunakan rumus yang sudah dijelaskan sebelumnya: (1 - (1 + 0,07) - 5) / 0,07 = 4,1004. Setelah itu, kamu dapat menghitung nilai investasi nilai kini dengan cara mengalikan arus kas dengan PVIFA: Rp 10 juta x 4,1004 = Rp 41.004.000. Dari sini, dapat disimpulkan bahwa.

How to calculate PVIF and PVIFA on Calculator JAIIB AFM YouTube

The PVIFA, or present value interest factor of annuity, is a measure of how much value your money will acquire in the case of a long-term investment.. To calculate the PVIFA, you must know the interest rate for a given period of time and the number of these periods you are interested in. The PVIFA tells you, generally, that x money today, if invested, will have a greater value after a given.

Rumus Beda Potensial atau Tegangan (1)

Rumus perhitungan PVIF adalah sebagai berikut: PVIF = 1 /(1 + r) n. di: PVIF = Faktor Bunga Nilai Sekarang r = tingkat bunga per periode n = jumlah periode. tabel PVIF. Anda juga dapat menggunakan tabel PVIF untuk mencari nilai PVIF. Di bawah ini adalah tabel PVIF yang menunjukkan kisaran suku bunga PVIF dari 1% hingga 30% dan jumlah.

PPT NILAI WAKTU UANG (TIME VALUE OF MONEY) PowerPoint Presentation, free download ID5189043

Present Value Interest Factor - PVIF: The present value interest factor (PVIF) is a factor that is utilized to provide a simple calculation for determining the present value dollar amount of a sum.

PPT Analisis Nilai Waktu Uang PowerPoint Presentation, free download ID5188941

The formula for Present Value Interest Factor is: PVIF = 1 / (1+r)n . r = discount rate or the interest rate. n = number of time periods. The above formula will calculate the present value interest factor, which you can then use to multiply by your future sum to be received. 3.

PPT NILAI WAKTU UANG (TIME VALUE OF MONEY) PowerPoint Presentation, free download ID5189043

Here is an example of how you can use the PVIF and the formula to calculate the present value of a future sum of money. Let's say that Company X is set to receive $100,000 in five years' time. The current discount rate is 5%. With this information, and using the formula laid out above, we can make the calculation. PVIF = 100,000 / (1+0.05)5.

PPT TIME VALUE OF MONEY PowerPoint Presentation, free download ID5415260

Now, the term or number of periods and the rate of return can be used to calculate the PV factor for this sum of money with the help of the formula described above. PV factor = 1 / (1+r) n = 1/ (1+0.05) 2 = 0.907. Now, multiplying the sum of $1000 to be received in the future by this PV factor, we get: $1000 x 0.907 = $907.